Digital Banking Weekly | 2021 #9

Be sure to read Ross Republic's deep-dive analysis of European fintech players that are offering new digital business banking services for SMEs.

Several well-funded FinTech companies that exclusively focus on serving the freelance or SME market segment have been founded in Europe over the last years.

For instance, Paris-based Qonto raised €136 million, London-based Tide raised €156 million and Amsterdam-based Finom recently raised €17 million in venture capital.

Here are a few of the key highlights that Ross Republic uncovered in their market research:

⭐️ The median founding date of all analyzed fintech companies is 2015

⭐️ The FinTech companies are active in over 48 countries, mostly driven by expansion efforts of N26 Business and Revolut Business

⭐️ Licensing strategies differ greatly: accounting- and admin- focused apps are running on whitelabel Banking-as-a-Service (BaaS) partners, while fintech companies with strong financial services value propositions are usually acquiring a full banking license

⭐️ Total funding tops over four trillion euros, however not all companies disclosed their external financing rounds

👉 Read more here. 👉 Link to Airtable here.

PODCAST

Secret Leader's inaugural podcast episode with Tom Blomfield is a must hear this week.

From raising £1m from crowdfunding in 96 seconds, to how he scaled personally alongside the bank, to building a culture from the very outset, to what made him leave Monzo - Tom is exceedingly candid in this interview, which was recorded just a few weeks after his departure. Don’t miss this hugely insightful episode from one of Europe’s top founders and CEOs - it’s something all entrepreneurs need to hear.

👉 Listen here.

The podcast recommendation of the week belongs to Ross Republic. In their fourth episode, hosts Adrian Klee and Mikko Riikkinen discuss the future of banking services for small and medium-sized enterprises.

👉 Listen here.

REPORT

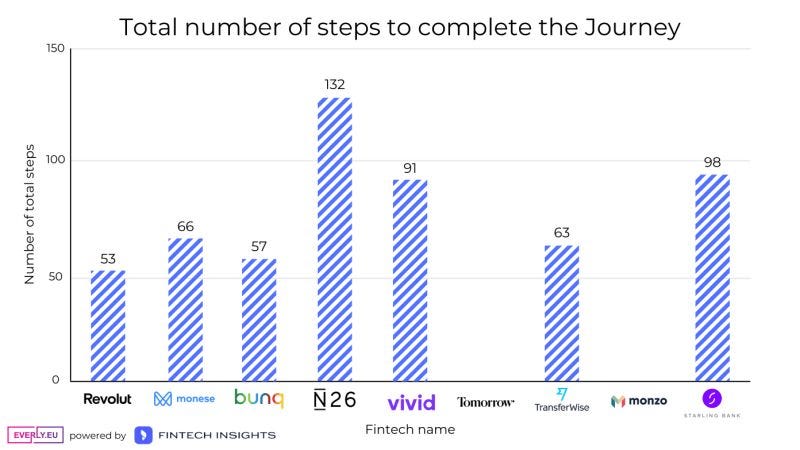

Interesting article by Šimon Kočí and FinTech Insights:

Challenger bank comparison – who is the fastest? How to send someone money within 25 minutes? Šimon wanted to find out who is the fastest and who is the best in this process.

1 – How many steps does it take to make your first payment from not having the app to paying with your smartphone?

2 – What bank is doing well and what could be improved in this process in terms of user experience?

👉 Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHTS

Revolut has operationalized its European specialized banking license in 10 European markets. Customers in Bulgaria, Croatia, Cyprus, Estonia, Greece, Latvia, Malta, Romania, Slovakia, and Slovenia who upgrade to Revolut Bank for additional services will now have their deposits protected under the deposit guarantee scheme. Link here.

INDUSTRY HIGHLIGHTS

⭐️ What’s Next for Your Bank? The second edition of “Fintech & Digital Banking 2025 Asia Pacific” by IDC and Backbase. Link here.

⭐️ UK Chancellor of the Exchequer at HM Treasury, Rishi Sunak, announced ahead of his budget that he would be more than doubling the current contactless spending limit. Link here.

⭐️ Optima Consultancy published the 2nd edition of the German Mobile Banking App Review, in partnership with Visa. Link here.

⭐️ By focusing on niche communities, these digital banks try to stand out in a crowded field. Link here.

⭐️ Want to co-invest alongside me in the most promising FinTechs? Join my Angel Investors Syndicate. Link here.

UNITED KINGDOM

Tide has joined forces with SME accounting firm Crunch in its latest partnership. The new collaboration will allow Crunch users to easily set up a business banking account with Tide and enhance the two firms’ financial data sharing. Nicholas Illidge, head of partnerships at Tide, said: "Tide and Crunch share a mission to make life easier for small business owners by simplifying admin and accountancy tasks.” Link here.

Countingup, the U.K. FinTech offering a business current account with built-in accounting features, has closed £9.1 million in Series A investment. Leading the round is Framework Venture Partners, with participation from Gresham House Ventures, Sage, and existing investors. Link here.

Atom bank is partnering with fintech Credit Kudos to further enhance its open data capabilities for business loan affordability assessments and deliver £1bn in lending over the next two years. Link here.

EUROPE

Íslandsbanki's users to track their carbon footprint, Mansa raised €18m, and Orange is seeking buyer for its bank division.

Iceland's Íslandsbanki is to enable users to track their carbon footprint through their mobile banking app. The bank is embedding Carbon Insights, Meniga's inaugural green banking product into its digital banking offering, providing users with an estimate of their overall carbon footprint based on their spending profile, broken down into spending categories and time periods. Link here.

French alternative lender for the self-employed Mansa has raised €18m. The deal is made up of €6m in equity capital from Anthemis Group and Founders Future and €12m in debt from a Franco-British fund to finance its loans. Link here.

Orange, France’s largest telco, is seeking a buyer for its loss-making bank division, which was launched back in 2017. “We did not set up this project to become a banker but to measure our capacity for innovation,” said Orange’s chief executive, Stéphane Richard. Link here.

mano.bank is truly a digital bank, delivering easy access to financial products for both individual customers and businesses. Licensed in 2018 by the European Central Bank. Link here.

ING is announcing that it is reviewing the strategic options for its Retail Banking operations in Austria with the aim of exiting this market by the end of 2021. The scope of the review focuses solely on ING’s retail business. ING will continue its Wholesale Banking activities in Austria. Link here.

Swedish Banking Platform Juni, chooses RegTech platform TruNarrative to provide onboarding and compliance technology. TruNarrative will deliver Juni the latest compliance and onboarding technology, providing the capability to successfully onboard and monitor their individual and business clients. Link here.

UNITED STATES

Square announced its industrial bank, Varo Bank introduced the Varo Believe Program, and Step announced it has crossed one million users.

Capital On Tap announced that it is launching in the United States, providing access to much-needed financial support for American small and medium-sized businesses (SMBs) through its innovative business credit card proposition. Capital on Tap is partnering with WebBank, which is the issuer and lender in the Capital on Tap credit card program. Link here.

Many small businesses around the world rely on alternative financing companies for their capital with traditional banks often having strict requirements such as a good credit score. Non-bank lenders like PayPal aim to be the source of funding for these businesses often having less stringent requirements. Link here.

Square, Inc. announced its industrial bank, Square Financial Services, has begun operations after completing the charter approval process with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions. Link here.

Treasury Prime, the leading Banking as a Service (BaaS) company, announced that it has partnered with Marqeta, Inc, the global modern card issuing platform, to bring Marqeta’s modern card issuing capabilities to the Treasury Prime API. Link here.

Mobility Capital Finance (MoCaFi), a financial technology, mobile-first banking platform, and Mastercard are partnering to bring alternate financial services to underserved communities with a specific focus on providing tailored digital tools, and new payment cards to low wealth minority and Black communities. Mastercard has now furthered its commitment with a capital investment in MoCaFi. Link here.

Varo Bank introduced the Varo Believe Program, an innovative credit building product that includes a Visa credit card and credit monitoring. The Believe Program is aimed at the 45 million Americans who are "credit invisibles" - meaning they have insufficient credit history to qualify for credit - and the millions more who are seeking to improve their credit score. Link here.

Step announced it has crossed one million users. A first of its kind, Step offers users the ability to build credit before they turn 18 through a free, FDIC insured bank account, secured spending card, and P2P payments platform. The company also recently closed a new venture debt facility and added major star power with baseball legend Alex Rodriguez and digital megastar Josh Richards joining Step as investors. Link here.

LATAM

Stori launched its credit card product in Mexico in January 2020 and has so far had more than 1 million customers apply for a card. Several members of the founding team spent years at Capital One honing their skills in underwriting underserved populations, while others worked at the likes of Mastercard, Morgan Stanley, GE Money, HSBC, and Intel in Mexico and the U.S. Link here.

Mexican salary advance startup minu has raised $14 million in Series A funding. The round includes $2.5 million of debt from Banco Sabadell Mexico. To date, Minu has raised a total of $20 million. Link here.

ASIA

Fintech companies MyMy Payments Malaysia Sdn Bhd (MPM) and Sukaniaga Sdn Bhd (SSB) announced their partnership to form a digital banking consortium and bid for one of five digital banking licenses to be issued next year by Bank Negara Malaysia (BNM). Link here.

Zaggle Prepaid Ocean Services Pvt. Ltd., a 2011-founded Software-as-a-Service (SaaS) fintech based out of Mumbai, has registered a new fintech start-up called “ZikZuk”. ZikZuk is a new banking platform in India focused on SMEs and SME lending. It classifies SMEs as companies that turnover between $1.5-2 million, all the way up to $100 million. Link here.

Nihon Unisys will start a joint project with Kyushu Financial Group (KFG) to adapt the U.S. neobank service “Moven” for KFG’s smartphone app to be provided to the region’s customers centered on digital natives. Through the provision of Moven, Nihon Unisys will support KFG’s creation of new services and value using digital technologies. Link here.

MIDDLE EAST

Rewire, which developed a mobile banking platform for international cash transfers tailored for the needs of expatriate workers, announced that it has completed a $20 million Series B funding round. Link here.

MOVERS AND SHAKERS:

Banxware announced the appointment of former Klarna Group Lead for Decision Infrastructure Diogo Simões as the new Chief Technology Officer. Diogo brings leadership experience, unique technological expertise, and deep knowledge of fintech products to his new role. Link here.

Green Dot Corporation announced Amit Parikh is joining the company as Executive Vice President of its Banking as a Service division. Link here.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost