New US-Mexico Payments Pathway Will Tap Rural Community Banks

Weekly news up to Monday, 5th of August 2024

👀 NEWS HIGHLIGHT

Cronos (CRO) and Revolut have announced a partnership to introduce a new cryptocurrency education initiative, the Cronos Learn course, now available on the Revolut app. This collaboration aims to demystify crypto and Web3 technologies, making them more accessible to the general public, according to Cronos Labs.

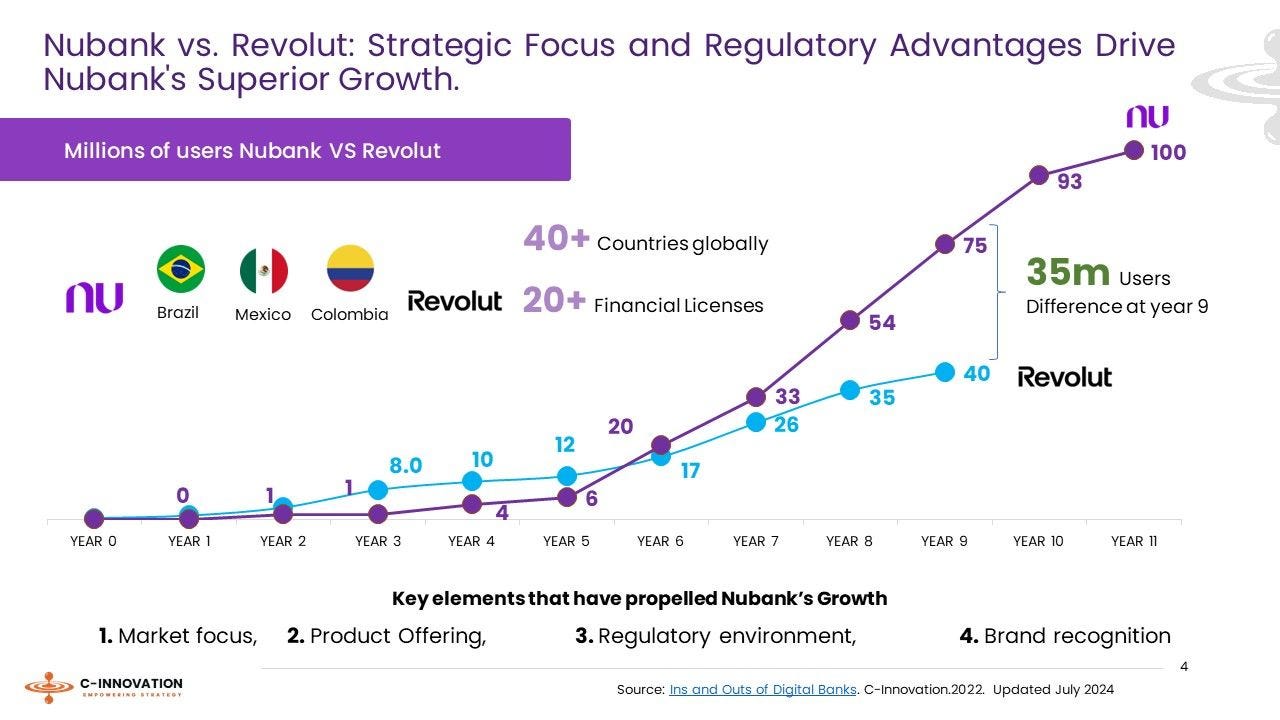

📊 INFOGRAPHIC

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut tells staff it is launching share sale at $45bn valuation.

⭐️ New US-Mexico payments pathway will tap rural community banks.

⭐️ Tuum forms partnership with ComplyAdvantage.

⭐️ Nubank managed to triple its deposit business in Mexico.

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Global payments and financial platform Airwallex has selected GoCardless to provide direct debit to its customers across several markets. Airwallex has launched the service in the UK, with Europe expected to follow soon after this announcement.

10x Banking launches world’s first ‘Meta Core’ to help banks achieve full transformation faster. A meta core solves the challenges of legacy cores and avoids the complex set-up and scale challenges of neo cores, providing a de-risked, accelerated path to full cloud-native transformation.

Monzo banks on Grow with SAP. This move will simplify Monzo’s finance IT estate, enabling it to fully embrace the benefits of the cloud, increasing innovation and meeting customer and market demands.

Bank of England calls for input on payments innovation. The central bank has published a Discussion Paper that sets out its response to rapid innovations in payments and their impact on monetary and financial stability.

Metro Bank shares soar as lender sees return to profit in Q4. Britain's Metro Bank forecast a return to profit in the fourth quarter on Wednesday following cost-saving measures during the year and a cash injection from the sale of its residential mortgage book, sending its shares 20% up.

Ampere, the neobank providing all-in-one financial services for SMEs, has announced its partnership with Mastercard to expand its services and transfers offering, marking a milestone in its mission to streamline financial solutions for SMEs.

EUROPE 🇪🇺

Westpac announced that its first third party Open Banking integration is now live with BlinkPay. BlinkPay is a Māori FinTech company that enables businesses to accept customer payments direct from a bank account.

Banca d’Italia: Halt on new customer onboarding for Qonto in Italy. On July 25, Banca d’Italia issued a temporary ban on new customer onboarding for Qonto's Italian branch. Existing customers can continue to use all of Qonto's corporate banking services. However, the opening of additional sub-accounts and the issuance of new debit cards are restricted.

Konsentus Verify now available on Temenos Exchange. Konsentus Verify provides Temenos open banking and open finance customers with the ability to check in real-time the identity and authorisation permissions of any third party at the time an account access request is made.

Paris-based BNP Paribas is working with telecom service provider Orange to provide its 21.8 million customers with personal financing solutions. The “tailored financing” will provide customers with loans up to 3,000 euros ($3,200) to buy mobile phones, according to the release.

USA 🇺🇸

JPMorgan Chase has rolled out an inhouse developed Generative AI chatbot to staff, likening it to having a research analyst at your desk. Dubbed LLM Suite, the bot is designed to help with writing, idea generation and summarising documents, executives told staff.

Monzo, the mobile banking app, announces the launch of interest on Savings Jars, designed to supercharge the savings of customers across the US. Monzo's Jars allow customers to sort their money and separate their savings.

Monzo is introducing new security controls to combat rising fraud, although concerns around the viability of two of these measures suggest uptake may not be strong. This measure cuts the window of opportunity for scammers (if consumers are out, they will not be able to facilitate a transaction).

ASIA

Singaporean neobank Fingular turns profit in Malaysia in just 9 months after launching under the Tambadana brand. Fingular's advanced processes enabled it to quickly pass a regulatory audit, marking a key milestone in the Malaysian FinTech market

Digital bank GXS, set up by Grab and Singtel, targets profit by 2027. The Singapore lender targets financially underserved sectors such as gig economy workers and small companies, segments that often transact over the Grab app in the city-state, creating a data trove that can shed light on creditworthiness.

Neobanking startup Zolve to raise $25 million from Creaegis as part of larger round. The new round values the company at around $330-360 million.

AUSTRALIA 🇦🇺

Australian bank Westpac is now offering debit cards to children as young as eight in a move it says will help them hone their financial skills. The move comes as a Westpac survey shows that three quarters of parents are already teaching their children some form of financial digital literacy.

Neobroker Stake dumps Sanlam and eyes new wealth play. The tide is beginning to turn on ‘shadow licensing’ in Australia’s financial services sector as the nation’s third largest retail broker Stake secures a licence in its own right and looks to evolve into a broader wealth management platform.

Up introduces Travel Mode: The ultimate solution for Aussie travellers. By integrating the currency converter toggle into Up’s ecosystem, customers can easily see their spending balance in both AUD and the local currency, simplifying money management.

AFRICA

The African tech landscape is bustling with possibilities, yet the recent challenges faced by local startups following a decision by notable startup favourite Mercury Bank, to shut down accounts linked to Nigeria and several other countries, has been both a rude awakening and a reality check. Here is how homegrown FinTech Verto aims to fill void of Mercury fallout in Africa.

Flutterwave’s Ghana payment license paves way for secure transactions. The milestone marks a significant expansion of Flutterwave’s operations in Africa, enabling the company to offer a comprehensive suite of payment services directly within, and through Ghana.

Raenest, Leatherback, Vesti, and Graph pitch themselves to African founders as Mercury alternatives. African FinTechs that help companies access banking services in the U.S. and Canada are wooing founders affected by Mercury’s recent abrupt compliance changes.

MOVERS AND SHAKERS

ING appoints Daniele Tonella as Chief Technology Officer and member of the Management Board Banking. He will succeed Marnix van Stiphout who has held the role ad interim since 1 November 2023, in addition to his roles as chief operations officer and chief transformation officer.

Wells Fargo has appointed a new head of technology and shunted current CIO Tracy Kerrins to head up a newly-created Generative AI team. Under the re-org, Kerrins will serve as the head of consumer technology and will lead a new Generative AI team, which will be responsible for driving the adoption of the technology across the bank, reporting to Engle.

Barclays announced the appointment of Jonathon Traer-Clark as Head of Americas for Barclays Global Transaction Banking (GTB) business. In this role, Jonathon will continue to progress GTB’s growth strategy, as it increasingly supports treasury teams at UK and European based businesses with services in the US.