👀 NEWS HIGHLIGHT

London-based FinTech company MuchBetter has partnered with NatWest to launch corporate accounts through its new business banking offering, MuchBetter Business (MBB).

The new service, built on Temenos' banking technology, offers business operational accounts in 35 currencies, enabling firms to conduct foreign exchange transactions and process payments across the UK, the Eurozone, and international networks. The platform also includes web and mobile banking applications for account management.

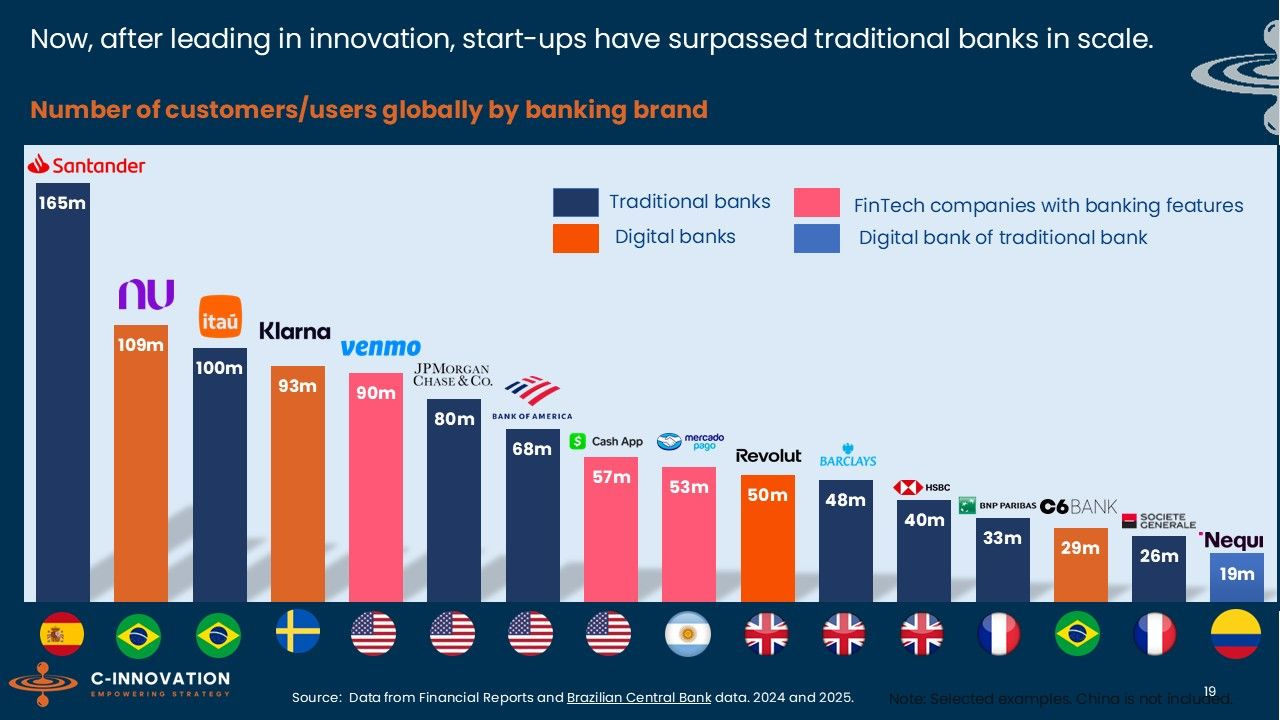

📊 INFOGRAPHIC

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut joins new European payment wallet “Wero”.

⭐️ Orange set to check out of Anytime FinTech subsidiary.

⭐️ Revolut’s CFD Trading Lead leaves after 3 years as Head of Wealth & Trading.

⭐️ Quant makes money smarter with rollout of industry-wide programmable money.

Subscribe to my Spanish Daily FinTech Newsletter for daily updates and analysis on the evolving world of financial technology—entirely in Spanish. Join now and stay in the loop!

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Chase to launch its first-ever credit card next month. The launch will follow some changes to its savings account and popular current account. Last week, Chase cut the interest rate on its boosted savings account, meaning savers can now only earn up to 4.5%.

Online criminals attacking HSBC ‘all the time’, says Ian Stuart, head of UK arm, with cybersecurity now its biggest expense, costing the lender hundreds of millions of pounds, amid growing concerns that other large businesses could fall victim to the kind of attacks that have caused chaos at retailers.

FinTech Fiinu massively narrows annual losses & monthly burn rate. The company completed a £1.25 million equity raise in February and secured a £511,000 R&D tax credit in May 2025, extending its financial runway through at least mid-2026.

EUROPE 🇪🇺

Qonto is launching POS terminals, tap to pay, and payment links. Qonto partnered with Adyen for its POS terminals and Tap to Pay solutions, and with Mollie for its Payment Links offering. This strategic expansion marks Qonto's evolution from a business finance leader to a complete financial management one-stop shop, addressing one of the most pressing needs faced by European SMEs today.

Raiffeisen Bank goes live with Temenos Core in Bosnia-Herzegovina. The core modernization marks a significant milestone, enabling Raiffeisen Bank to enhance customer experience and drive greater efficiency. Continue reading

BBVA overhauls mobile app with AI and virtual financial coach. AI allows each customer to organize the app based on their financial preferences. Blue, which is now able to answer customer questions with natural language, the app is also incorporating a new financial coach.

Qonto and ACD join forces to ease the weight of admin work for French SMEs and accountants. This solution simplifies the daily banking, financing, accounting, and expense management of SMEs and the self-employed. It gives customers the boost that allows them to develop further.

UniCredit escalates Banco BPM fight by taking Italy to court. The claim aims to address the legitimacy of the "golden power" under Italian and EU law, and UniCredit will support the EU's review of the situation. Read more

USA 🇺🇸

Capital Bank partners with Q2 for its new digital banking platform. The launch aims to offer a secure and modern experience for business customers and marks a step in the bank’s digital transformation. Its new digital platform delivers digital treasury management capabilities and aims to offer the users the scalability needed to expand into new markets and customer segments.

Openbank by Santander reaches 100,000 customers in the United States, well-positioned for continued growth in 2025. This achievement is a significant milestone in advancing the Santander US business strategy to generate lower-cost, national deposits to position its Retail Bank for further success and fuel its leading Auto lending franchise.

Santander introduces the first Openbank location in the United States at Miami Worldcenter. The new location will offer all of the services of a Santander Bank branch, and information about its Openbank division’s digital-first banking products.

Samsung partners with digital bank N26. Samsung users can easily pay with their Galaxy smartphone without having to pull a card out of their wallet. To kick off the partnership, customers who open a new N26 account will receive the opportunity to use the premium N26 Metal account free of charge for six months.

JPMorgan expands tech team with four veteran bankers from BofA, Goldman, Lazard. These appointments are part of JPMorgan's broader strategy to enhance its technology investment banking capabilities, reflecting the sector's increasing significance in the global economic landscape.

LATAM

Nu Mexico and OXXO launch cash deposits. This new feature will allow customers to deposit securely and conveniently through the extensive network of more than 23,000 OXXO* stores using a deposit code, simplifying access to digital finance for a significant portion of the Mexican population for whom physical cash remains relevant.

ASIA

Ringkas raises US$5.1 mil pre-series A round to bring AI-powered mortgage solutions to Malaysia and Southeast Asia. The new funding will strengthen the company’s position as a key player in financial infrastructure by supporting the development of future AI capabilities and expanding its regional reach.

FAB pilots virtual B2B card solution with Oracle and Mastercard. The new system is intended to address long-standing inefficiencies in corporate payment processes, such as manual data entry, disjointed workflows, and limited financial visibility.

Emirates Development Bank launches Fee-Free Digital Banking Platform to support UAE entrepreneurs. From a single app, entrepreneurs will be able to manage payroll, invoicing, and payments, monitor cash flow, and access a growing suite of value-added services.

Revolut Business Chief James Gibson: We Want to Double Our Swiss Client Base. Gibson outlined the neobank’s growth strategy, which includes new investments, enhanced foreign exchange tools, seamless onboarding processes, and the upcoming introduction of payment terminals for merchants, directly challenging the market dominance of Worldline.

AUSTRALIA 🇦🇺

Bank of Sydney turns to Infosys Finacle for digital banking. Through this strategic collaboration, Bank of Sydney aims to deliver a best-in-class staff and customer experience, reduce cost and complexity through automation and digitization, and position itself strongly for future growth.

MOVERS AND SHAKERS

Youssef Lahrech steps down as COO of Nubank. Lahrech will maintain a role at Sao Paulo-based Nu as permanent observer on the board’s audit and risk committee, and he will advise the company on credit strategy. The company said it continues to “streamline efficiency” and speed its operations.

Youssef Lahrech steps down as COO of Nubank. Lahrech will maintain a role at Sao Paulo-based Nu as permanent observer on the board’s audit and risk committee, and he will advise the company on credit strategy. The company said it continues to “streamline efficiency” and speed its operations.

Goldman Sachs hires Tommaso Ponselé for the new capital solutions team. He is joining the company as a managing director within its capital solutions unit. Goldman launched the unit in January as part of a new push to do more work with financial sponsors and do more work in the private credit space.