SoFi Brings Financial Wellness to the Small Business Workplace

Weekly news up to Monday, 21st of July 2025

👀 NEWS HIGHLIGHT

Super.money, the FinTech arm of Walmart-owned Flipkart, is exploring an entry into stock broking, signalling the next big step in its journey towards becoming a full-stack financial services platform.

“We are reimagining stock trading for the next wave of investors. We believe investing shouldn’t feel intimidating, cluttered, or built only for the ‘experts'," founder Prakash Sikaria said in a LinkedIn post on July 17.

The payments and lending firm is looking to build a simplified trading interface at the intersection of UPI, AI and broking, which will make trading "effortless for millions of new investors to get started", he said.

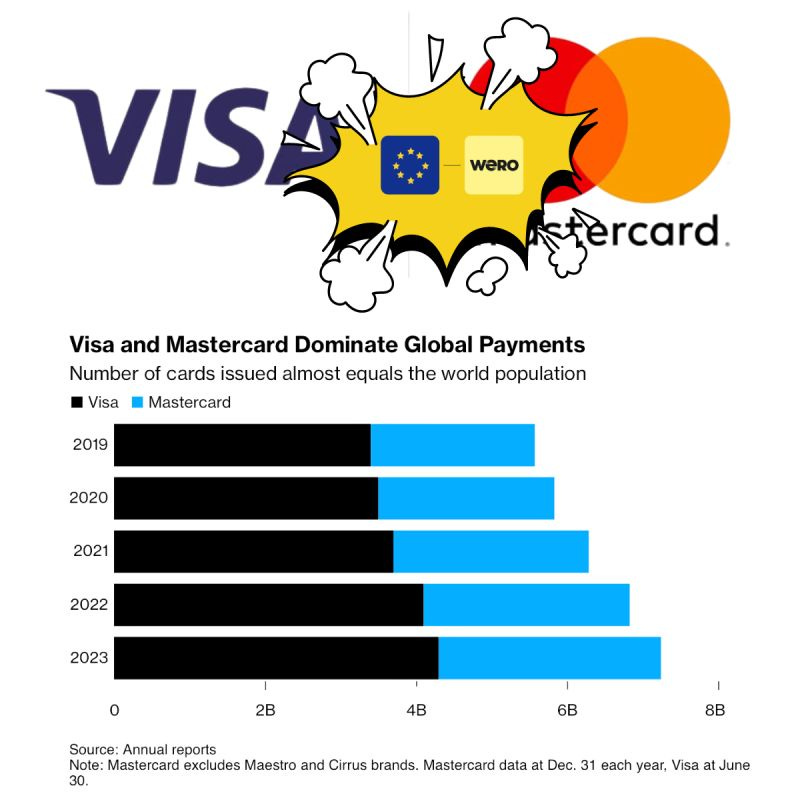

📊 INFOGRAPHIC

Five Belgian Banks are preparing to launch Wero, expanding the European Payments Initiative’s footprint and accelerating efforts to unify the continent’s digital payments environment.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ AIB promotes CTO to COO amid tech reorganisation.

⭐️ Cathay United Bank taps Avaloq to launch onshore private banking operations in Taiwan.

⭐️ SoFi Brings Financial Wellness to the Small Business Workplace.

⭐️ FinTech and Crypto Industries Launch Fight to Block Bank Fees for Customer Data.

Stay informed on key FinTech deals worldwide. Subscribe now for your weekly updates.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Monzo unveils flexible home insurance for homeowners. Monzo Home Insurance is available to UK homeowners, giving them a flexible and transparent approach to home protection. The Monzo app powers this digital insurance solution, which is designed to be simple, quick, and give customers control.

StanChart launches bitcoin and ether spot trading for institutional clients. Institutional clients, including corporates, investors, and asset managers, can now trade digital assets through familiar FX interfaces, and will soon be offered non-deliverable forwards trading, StanChart said in a statement.

FCA fines Barclays £42 million for poor handling of financial crime risks. Barclays Bank UK PLC failed to check that it had gathered sufficient information to understand the money laundering risk before opening a client money account for WealthTek.

Starling Bank makes major comms restructuring. Alexandra Frean has stepped down as Chief Corporate Affairs Officer at Starling Bank, as part of a shake-up of the comms team. Read more

EUROPE 🇪🇺

myTU enables instant global payouts with Visa Direct and Mastercard cross‑border services. This integration empowers businesses and individuals to send real-time payouts, including salaries, insurance claims, refunds, and gig-economy payments to eligible cardholders, as well as directly to bank accounts in supported markets.

Vivid Money and Adyen launch payouts on speed. Adyen processes have been integrated into the Vivid Money interface, allowing customers, upon acceptance of Adyen's terms and conditions, to withdraw revenue from payments directly to their account.

Revolut is launching a loyalty program in Poland, called RevPoints. Revolut customers will be able to collect points for everyday transactions and then redeem them for attractive rewards, including airline miles, public transport tickets, hotel discounts, eSIM data, and purchases using Revolut Pay.

Fideus teams up with Holvi to simplify holding setups. Fideus takes care of the full setup for holding companies, from incorporation to tax returns and annual reports. All-in-one digital platform, powered by AI. And up to 60% less effort and cost than a traditional tax advisor.

N26 strengthens travel offer with travel eSIM mobile plans and 1% cashback on international travel spend. Customers can enjoy flexible data plans with best-in-class prices, choosing from different plan sizes tailored to their destination. They can activate travel data plans for over 100 destinations in just a few taps.

USA 🇺🇸

Former Coinbase exec raises $12.5 million for Dakota, a stablecoin-powered neobank. The injection of capital into Dakota, which uses stablecoins to move money between itself and its customers, is the latest bet from VCs on a company involved in one of the buzziest sectors of crypto.

Some big US banks plan to launch stablecoins, expecting crypto-friendly regulations. Stablecoins, a type of cryptocurrency designed to maintain a stable value, are typically pegged to a fiat currency, such as the U.S. dollar, and are commonly used by crypto traders to transfer funds between tokens.

Grasshopper Bank partners with Lendio to enhance SBA loan delivery with AI-powered tools. By leveraging advanced customer acquisition and AI-powered decision-making tools from Lendio, Grasshopper Bank plans to streamline the entire SBA top-of-funnel process from application to approval.

LATAM

Dock Executive Anderson Olivares de Oliveira arrested in Mexico for $10 million fraud. Olivares was detained at Mexico City International Airport following an alert from the Attorney General's Office. He is accused of fraud in a case involving corporate disputes and regulatory questions about the company's operations in the country.

ASIA

Kbank runs a senior call center to meet the needs of the aging population. The call center for older adults opened in early June, as they increasingly make up a larger share of customers in the asset management market amid longer life expectancy.

FinTech majors are counting on co-branded cards in returns play. Google Pay is in discussions to build a co-branded credit card with Axis Bank. This marks a shift for Google, which has so far avoided regulated businesses in India and pulled back its FinTech bets globally.

Wise opens global office in Hyderabad and plans major hiring. The company, which currently has 70 employees on its rolls in Hyderabad, plans to expand its workforce over the next few years. Additionally, UniCredit picks Wise to handle FX payments in latest retail push. The partnership comes after the lender launched a review and found it had “shortcomings” in its mobile banking payments offerings.

Jenius chooses Wise Platform to transform cross-border payments for millions of digitally-savvy Indonesians. Its customers will be able to benefit from faster cross-border payments, full price transparency, and real-time transaction tracking, as funds can be sent directly from their Jenius Foreign Currency accounts.

QIIB and Visa launch Biometric Click to Pay. Users can employ a unique identifier, such as their email address or phone number, to swiftly complete transactions with participating merchants. Integrated with Visa’s Payment Passkey Service, this solution leverages biometric authentication, eliminating the need for manually entering card details or one-time passcodes.

Jupiter Money bags corporate agency licence to enter insurance distribution. Jupiter can now distribute life and general insurance policies through its app. The FinTech platform will initially offer curated products, including term life and health insurance, in partnership with major insurers.

MOVERS AND SHAKERS

BBVA appoints Walter Rizzi as head of digital banking in Italy. His strong technical and strategic background makes him a key leader to drive the bank’s growth, aligning BBVA’s value proposition with the specific characteristics of the Italian market and cementing its position as an innovative digital banking institution.

BlockFi co-founder Flori Gilroy hired to lead revamped SoFi crypto unit. The new hire was quietly made official via an update to the masthead on SoFi’s website and confirmed by a source familiar with SoFi’s business operations. It’s unclear when Gilroy took on the new role.