REPORT

Banks are currently accelerating massive infrastructure updates in order to adapt to the changing times, but many are taking the wrong approach.

Rather than focusing on engagement, they’ve prioritized core banking solutions, and that’s one of the reasons their attempts so far have been unsuccessful.

As a result, the vast majority of banks don’t feel prepared to offer the exceptional experiences that customers demand.

Backbase’s exclusive Forrester infographic makes the situation clear:

whether financial institutions choose to adopt out-of-the-box digital infrastructure products or custom-build their own solutions, the only way forward is learning to own the customer engagement layer.

👉 Check the full Backbase article here.

👀 NEWS HIGHLIGHT

Revolut has given 50,000 people a £20 free credit after users of the app experienced delays in making purchases and carrying out transfers during the Black Friday sales.

The company told MoneySavingExpert.com (MSE) it had identified most people who encountered problems but said those who have not received a payment but did face difficulties, should get in touch.

Revolut contacted customers this week to let them know it had credited their account with £20 (or local currency equivalent), after some experienced delays in making purchases and transfers or topping up their cards during the Black Friday sales last month.

👉Read the full Money Saving Expert article here.

📰 ARTICLE

As we witness another year calling it a wrap, we reflect back on some of the breakthroughs that make 2021 the dawn of a whole new era for digital-first funding.

Needless to say, this year has observed some remarkable funding rounds that took over every headline possible.

A prompt overlook at the hierarchy of the neobanking investment galore puts the spotlight on the key neobanks who raised it big during the course of this year:

👉Read this great WhiteSight article here.

👨💻 BLOG

Digital banks and FinTechs alike must continue to make strong communications and marketing efforts to educate consumers about their services.

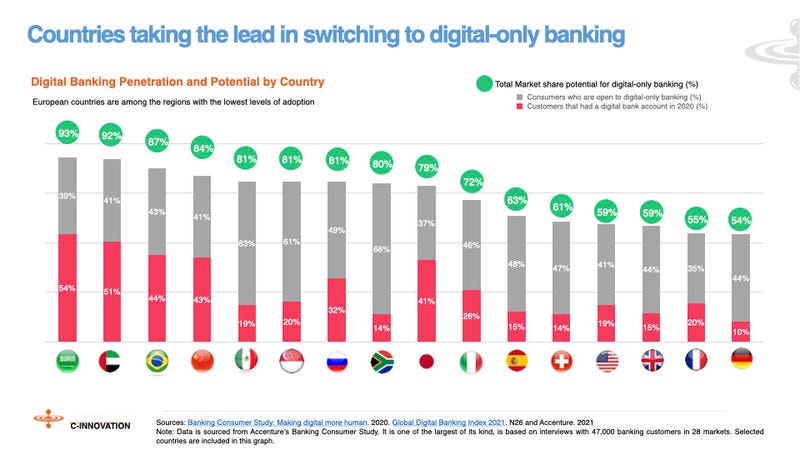

The potential for digital banking varies significantly from country to country, depending on a variety of factors.

The main reasons to not move from a traditional bank to a digital bank are lack of familiarity with the digital product or general satisfaction with one’s current bank.

👉Read the full C-Innovation blog here

💡INSIGHTS

Starling now counts 30 clients of its BaaS offering, up from 25 in September, including SumUp, CurrencyCloud, Moneybox, and, most recently, Standard Chartered.

From ClearBank and Thought Machine to Marqeta and Mambu, the landscape of players battling to provide the next generation of banking infrastructure has never been more competitive.

Starling’s chief banking officer is keenly aware of the competition but believes the challenger bank’s technological performance speaks for itself.

👉 Read the full Altfi article written by Oliver Smith here.

🎤 PODCAST

One of the podcast recommendations of the week belongs to episode 590 of 11:FS “News: Global Super Apps on the rise as Nubank IPOs and Lydia becomes a unicorn”.

Expert hosts, Gwera Kiwana and Amy Gavin, are joined by Gabriel Le Roux, (Co-Founder, Primer) and Bruno DIniz (Co-Founder, Spiralemto), to talk about the most notable fintech, financial services, and banking news from the past week.

👉Listen here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ An Irish financial software solutions company is suing Revolut over the online payment service firm’s use of an identical or similar payroll trademark. Link here.

⭐️ Starling Bank, as of the end of August 2021, had over 680 women in its workforce, making up a record 43 percent of the total headcount (1,601). Link here.

⭐️ Revolut, the financial superapp with more than 18 million customers worldwide, announced that it will bring Google Pay to Revolut Junior customers across the UK and EEA. Link here.

UK 🇬🇧

UK-based Barclays Plc received approval from Australia's prudential regulator to operate as a foreign bank in the country, as the lender continues its expansion into high-growth markets. Link here.

Challenger SME bank Allica Bank has joined the list of accredited lenders to the government-backed Recovery Loan Scheme (RLS). The RLS is one of a number of government-supported measures aimed at helping businesses impacted by Covid. Link here.

Zopa’s peer-to-peer lending business swung into a pre-tax loss of £8.5m last year, due to a reduction in lending volumes and a move away from charging upfront fees. This compares to a £575,000 profit the previous year, according to documents filed with Companies House. Link here.

Personal-finance startup Dave Inc. plans to use the roughly $450 million from its coming public listing for acquisitions, new products and possible investments in cryptocurrency. Link here.

U.K. challenger bank Monese has acquired Trezeo, a financial services provider for self-employed workers. The London-based company announced the acquisition — its first — on its website, saying it was part of a “wider push into credit and lending for independent, self-employed workers and those with untraditional lives and work.” Link here.

EUROPE 🇪🇺

Tinkoff Investments, the brokerage arm of TCS Group's (TCSq.L) online bank Tinkoff, said it would offer securities trading on weekends, the first broker in Russia to do so, in an attempt to attract more investors. Link here.

ING announced it is set to discontinue its French retail banking operations. The company launched ING France in 2000 as an online bank. It currently claims around 1 million customers and provides current accounts, mortgages, consumer lending, and investment products. Link here.

Viva Wallet, a European neobank with local presence in 23 countries through branches, acquired the 33.5% of Polish N7 mobile, a niche software development company. Link here.

Bnext, the Spanish fintech established in 2017 to be the alternative to traditional banking, which at the end of the third quarter had more than 600,000 customers worldwide, is preparing to launch its utility token in the first quarter of 2022. Link here.

USA 🇺🇸

New Jersey-based mutual community bank Manasquan Bank has selected digital assets firm Bakkt as it looks to provide its retail customers access to cryptocurrency. The partnership will see the bank take part in Bakkt’s “early adopter program”, which is due to launch in Q2 2022. Link here.

Oportun, an A.I.-driven FinTech company, announced it closed a $150 million credit facility secured by credit card receivables arising under its Oportun Visa Credit Card issued by WebBank. Link here.

CANADA

Mogo Inc., a digital payments and financial technology company, announced it has received final approval from the Investment Industry Regulatory Organization of Canada (“IIROC”) for the launch of MogoTrade, Mogo’s commission-free stock-trading solution. Link here.

LATAM

Brazilian unicorn Nubank has become Latin America’s most valuable bank, at US$41.5bn, to be listed on the NYSE following its December 8 IPO, when the neobank raised US$2.6bn. Nu México has already issued more than 760,000 cards, even becoming the country’s largest issuer of new credit cards during July and August. Link here.

ASIA

A new neobank designed exclusively for couples has launched in India. The Bangalore-based Fibbl bills itself as a neobank that allows couples to manage money as a team. Link here.

Mizuho Bank, Ltd. acquired shares of Online Mobile Services Joint Stock Company. MService is the leading digital payment company in the Socialist Republic of Vietnam, with a share of over 50% of Vietnam’s mobile payment market, and operates the MoMo brand. Link here.

StashFin, a neo-banking platform, which is among India’s leaders in the space, announced a host of new value propositions on its Credit Line Card. Link here.

Google-backed neobank Open is in the advanced stages of talks to close a fresh funding round of $100-150 million after which it will be valued at about $1.1-1.3 billion. Link here.

GajiGesa, a FinTech company focused on services for Indonesian workers, announced that it has raised $6.6 million USD in pre-Series A funding. The startup is aimed at unbanked workers and focuses on earned wage access, which lets people withdraw their wages immediately instead of waiting for monthly paychecks. Link here.

AUSTRALIA 🇦🇺

Openmarkets Group (OMG) is one of Australia’s largest retail brokers and provides technology solutions across wholesale execution, order, and risk management. Douugh has partnered with Openmarkets Group to offer a comprehensive array of integrated trading services across the NYSE, ASX, and Crypto exchanges. Link here.

MIDDLE EAST

The shareholders of Zand, the first digital bank in the UAE to provide both retail and corporate services, have completed the acquisition of the majority of shares in Dubai Bank ahead of its planned launch. Link here.

MOVERS AND SHAKERS

Igor Kuschnir, the managing director and CFO of digital business bank Penta, has announced he is stepping down after almost five years at the firm.

Writing on LinkedIn, Kuschnir says his time at Penta has been a “rewarding experience” and thanked the company and staff, but does not hint at what he intends to do next.

👉 Read the full Fintech Futures article written by Paul Hindle here.

OPPORTUNITIES

Atom Bank says it has had a 500 percent jump in applications for job vacancies since it introduced a four-day week for staff with no loss of pay.

Staff surveys are also showing that employees feel less stressed and that no evidence of a negative impact on customer service or operations has been detected in the two months since the digital bank broke ground by declaring that it would move permanently to a four-day week.

👉 Read the full The Times article written by Katherine Griffiths here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.