Digital Banking | 2022 #3

Weekly news up to Monday, January 17th, 2022

MVO BLOG

REPORT

2021 performance data reveals that most - but not all - Australian Open Banking APIs are fast and reliable.

On average, the API response time in 2021 was 0.86 seconds and the reliability was 98.8%. Neobank Up led the charge, with an average response time of 0.26 seconds and 99.88% reliability of their Open Banking APIs in 2021.

👉 Read the full FROLLO article here.

😎 SPONSORED CONTENT

Contis is transforming issuing & processing. We help organisations unleash their true potential with award-winning, cloud-based, real-time Banking-as-a-Service solutions. We put next-generation cards, accounts, and apps in the hands of your customers.

👀 NEWS HIGHLIGHT

A group of U.S. state banking regulators dropped their lawsuit seeking to block the federal government from granting bank charters to fintech companies on Thursday, after the company that was first in line modified its business plan.

The lawsuit sought to block approval of a charter application by Figure Technologies Inc, saying that the OCC, U.S. Office of the Comptroller of the Currency, lacked authority to classify companies that do not receive deposits as banks.

👉 Read the full Reuters article written by Jody Godoy here.

Looking for more US news? Sign up to our dedicated US Fintech Newsletter here 👇

📊 INFOGRAPHIC

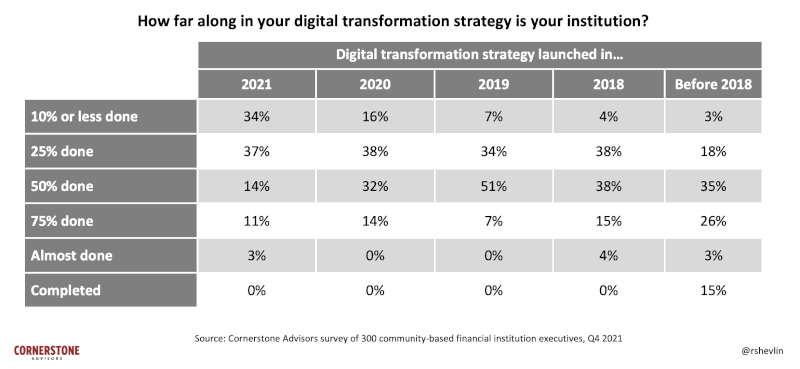

According to Cornerstone Advisors’ 2022 What’s Going On in Banking study, to date, three-quarters of banks and credit unions have launched a digital transformation initiative.

👉 Read the full article by Ron Shevlin here.

👨💻 BLOG

Solarisbank wrote in a blog post that during the past year, they’ve achieved some notable milestones. They launched in three new markets — Italy, Spain, and France — and “oversubscribed a €190 million Series D funding round.”

The team at Solarisbank also reports joining forces with Contis, a partnership that’ll put them at the “cutting edge” of Banking-as-a-Service (Baas) tech in the UK, the company claims.

👉 Read the full Crowdfund insider article written by Omar Faridi here.

📰 ARTICLE

Conduit aims to be a one-stop-shop for neobanks and financial institutions to plug their own products into the DeFi ecosystem. DeFi lending is far riskier than traditional lending, in part because of the volatility of the asset class.

Furthermore, Conduit is building a set of APIs that developers can use to build platforms that provide access to DeFi products. Just as “high-yield” bonds compensate investors with more cash for betting on riskier-than-average companies, DeFi lending can offer far higher interest rates than the traditional savings account wherein customers essentially lend their money to a bank.

👉 Read the full Techcrunch article by Anita Ramaswamy here.

💬 INTERVIEW

Consumer spending trends look "relatively positive" so far this year, Mastercard CEO Michael Miebach told CNBC on Thursday, following strong holiday numbers.

Miebach's comments in an interview on "Power Lunch" come as the Covid omicron variant remains widespread across the world, including in the U.S. Some retailers have warned of an impact on business operations, saying it's hurting sales and causing staffing challenges in stores and distribution centers alike.

Mastercard expects spending this year will be aided by built-up savings accumulated during the Covid pandemic, Miebach said.

👉 Read the full CNBC article here.

💡INSIGHTS

The past year has seen the launch of the Philippines’ first virtual-only banks.

This came amid the creation of a new regulatory framework for digital banks, a move motivated by the ambition to improve financial inclusion and raise the number of Filipino adults with bank accounts to 70% by 2023.

Download the full Fintech Philippines Report 2022 by FintechNews here.

👀 Looking for funding news? We've moved them to their own special weekly newsletter here.

👉 Read all about M&As, VCs, Down Rounds, IPOs, Funding Rounds, etc.

Subscribe to our #DoneDeal Newsletter and never miss an important update again.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Five US banks have come together to launch a bank-minted alternative to non-bank-issued stablecoins. Link here.

⭐️ Monzo is bringing its cash referral scheme back. Link here.

⭐️ Railsbank is launching a new white-label ‘buy now, pay later’ solution for retailers in the UK and Germany. Link here.

⭐️ As competition amid digital banks heats up, U.S. fintech Current is rolling out a new product designed to make its banking service more appealing. Link here.

UK 🇬🇧

After slashing its rates over the Christmas period, Atom Bank returned several of its savings account interest rates back to their September highs. Link here.

Despite the disruption of the Brexit vote and the pandemic, Revolut managed to keep raising funds, reaching $1,7B in funding in only 5 rounds since their debut. Link here.

Also, Revolut has launched as a bank in 10 Western European countries, enabling it to offer its customers in these markets deposit protection. Link here.

Tandem Bank has announced it is acquiring fast-growing consumer lender Oplo to create a fairer, greener digital bank for UK consumers. Link here.

Twig, a London-based fintech targeting Gen Z and younger millennial consumers with an e-money account that gives them instant cash-outs on fashion and electronics they want to sell, has closed a $35 million Series A round of funding. Link here.

Merchant Money, an SME lender, has gained accreditation to the government’s Recovery Loan Scheme (RLS) as well as a funding line in excess of £150m. Link here.

Ecospend, the leading UK provider of Open Banking technology, has announced that it is partnering with Contis, the leading pan-European Banking-as-a-Service (BaaS) provider. Link here.

Cashplus is expanding its offering to include insurance for SMEs via a partnership with UK insurtech Superscript. Link here.

According to a report in the Financial Times, the Bank of England’s Prudential Regulation Authority is looking at ways of assessing the “operational resilience” of cloud computing giants that have been edging their way into the financial services sector. Link here.

The chief executive officer of Starling Bank Ltd., Anne Boden, has a blunt new year’s message for Meta Platforms Inc.: Get rid of the fraudsters if you want us to advertise with you again. Link here.

EUROPE 🇪🇺

Monneo, a virtual IBAN and corporate account provider, has added a new European bank partner to its banking network, meaning it can now offer multi-currency IBAN accounts to customers. Link here.

N26 wishes it had launched a cryptocurrency trading service instead of concentrating on its global expansion. Link here.

Revolut has made it possible for customers in Poland to invest their savings in their native currency. Link here.

Temenos, the banking software company, has extended its strategic relationship with Red Hat, the world’s leading provider of enterprise open source solutions. Link here.

French startup Qonto has raised a $552 million Series D funding round (€486 million). Following this investment, the startup has reached a valuation of $5 billion (€4.4 billion). Link here.

USA 🇺🇸

Payflow, a YC-backed salary-advance fintech with ambitions to evolve into a neobank, has banked a $9.1 million Series A funding round — bringing its total raised since January 2020, when the business was founded, to $13.6M. Link here.

TipHaus has addressed this challenge by creating a challenger bank specifically for restaurant owners, managers, and workers. Now Moven is engaged with TipHaus to deepen the digital banking experience for this underserved community. Link here.

Novo has raised $90 million, a Series B round that values the Miami-based startup at $700 million. Link here.

Citigroup staff in the United States who have not been vaccinated against Covid-19 by January 14 will be placed on unpaid leave and fired at the end of the month unless they are granted an exemption, according to a company memo seen by Reuters. Link here.

CANADA

Mogo, a digital payments and financial technology company, announced a strategic investment in NFT Trader, a Canadian company that operates a secure peer-to-peer OTC trading protocol for non-fungible tokens or NFTs. Link here.

LATAM

Citi announced that it intends to exit the consumer, small business, and middle-market banking operations of Citibanamex as part of its strategic refresh. Link here.

Brazilian fintech Stefanini Group – through its core banking subsidiary Topaz – has acquired a majority stake in US core banking software provider Cobiscorp. Link here.

CARIBBEAN

Colour Bank, which has 'For the Culture' as its tagline, targets the Caribbean and African diasporas in the United States, promising customers that they will be able to open a bank account without a social security number and they will receive a free Mastercard debit card. Link here.

ASIA

Chennai-based neobank startup IppoPay has raised $2.1 Mn in a seed round from Coinbase Ventures, Better Capital, Blume Founders Fund, and several high-profile angel investors. Link here.

Tonik Digital Bank (Tonik), the Philippines’ first digital-only neobank, has tapped Google Cloud’s advanced platform to accelerate financial inclusion for all Filipinos. Link here.

Indian neobank Kaleidofin has raised $10 million in Series B funding, led by the Michael & Susan Dell Foundation. The new equity injection takes the total funding raised by Kaleidofin to $18 million. Link here.

Crowdo has closed an $8 million (5.9 million) pre-Series B bridge round co-led by existing shareholders Gobi Partners and Ivest Capital, a SE Asian family office. Link here.

AUSTRALIA 🇦🇺

One of Europe’s largest FinTechs, London-based Wise, has accused Australian banks of anti-competitive behaviour in refusing to provide it with banking services over several years, as the Council of Financial Regulators begins an investigation into “debanking” in response to concerns raised by Treasury and AUSTRAC. Link here.

MIDDLE EAST

Capital Banking Solutions is proud to announce the successful go-live of IMEIB, Iraqi Middle East Investment Bank, on its new digital banking platform, CapitalDigital. This successful implementation for IMEIB will offer their clients unique e-banking and mobile banking experience. Link here.

MOVERS AND SHAKERS

Paysend, the card-to-card pioneer and international payments platform, announced the appointment of Jairo Riveros, as managing director of the United States and Latin America, effective 01 January 2022. Link here.

FloBiz, a Bengaluru-based fast-growing SMB neobank, appoints Rabi Agrawal as Head, Human Resources. In the last 12 months, the FloBiz team has grown 300% in size and Rabi will assume charge of the talent acquisition, management, and people operations for the organization. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.