Digital Banking Weekly | 2021 #2

Nala is launching a new money transfer app, Starling is on the hunt for acquisition targets, and Asto UK is set to shut down.

Welcome to my first newsletter article on Substack!

I moved my weekly newsletters to Substack and here you can read why…

If you want to be sure you get this weekly newsletter in your inbox in the future, you need to subscribe:

For you, as an early adopter of my newsletter(s), I have a 👉Special Offer👈

Now on to this weeks news overview:

Have you ever wondered how your competitors tackle the same challenges as yourself? Or what's the leading alternative solution to a common FinTech issue?

In my own research, I use Scientia Consulting to get to the minutiae of insights. As an investor, I base my strategies accordingly. For example, I had a great time comparing two colossal FinTech banks in my Starling vs Monzo article.

Find out more and learn first-hand some of the details I was able to extract here.

If you want to know more about Scientia, read on for my Podcast recommendations 😏

PODCAST

This week, one of our podcast recommendations belongs to Wharton Fintech! Miguel Armaza sits down with Dan Henry, CEO of Green Dot, a 20-year-old company focused on making modern banking and money movement accessible for everyone. Green Dot also recently launched Go2Bank a digital bank for Americans living paycheck to paycheck. Green Dot is far from being Dan’s first rodeo. In fact, this is the third publicly listed company he’s led in the last three decades. Listen more here.

Also, be sure to watch Breaking Banks’ Episode 372: The Nitty Gritty of Innovation by Provoke Media. In this episode of Breaking Banks, they explore the worlds of benchmarking and procurement. Some would call them “unsexy,” but the real winners know they are necessary and essential to get ahead and stay ahead. Regular contributor Jim Marous join Brett King to sit down with Pawel Oltuszyk co-founder of Frost and Erenia Kontolatou, VP of Business Development at Scientia Consulting, to chat about the competitive advantage of benchmarking. Listen more here.

INTERVIEW

Vietnam’s first digital-only bank, TNEX, has arrived with a splash. Nextgen Core Banking Solutions spoke to CEO, Bryan Carroll, about entering a market where 80% of people are under 52, about what’s gone into building the bank, what’s wrong with existing banks, how soup played a part in the planning, and its Banking-as-a-Service (BaaS) ambitions. Read more here.

REPORTS

Apart from the product-market fit and launch timing, the founding team is considered as one of the key constituents to a startup's success. What best place to look for empirical evidence of the founding teams' traits: The top 20 Independent Neobanks. Here's WhiteSight’s analysis of the hustlers, the growth-hackers, the visionaries behind the success of top neobanks. Read more here.

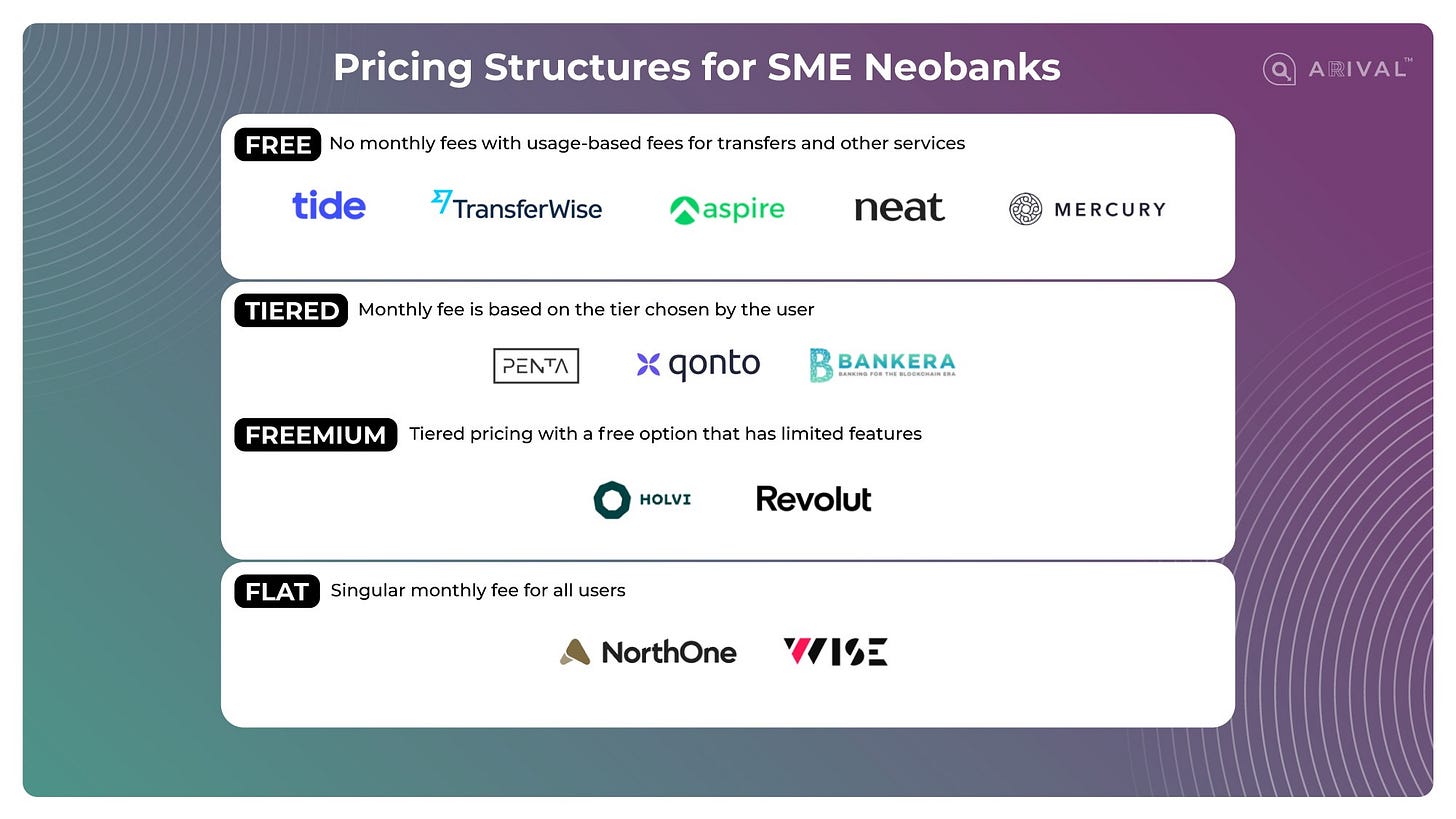

Unpacking Neobanks for SMEs is an article series by Arival Bank analyzing the SME neobanks landscape from the lens of the user experience journey. This week: Chapter 5 - Pricing Structures.

"A clear pricing structure goes a long way to making a smooth onboarding. It enables the customer to get the best value for the product they paid for. For neobanks, pricing is not just a tool for customer acquisition, but also monetization.

What does it mean to have price transparency? How do neobanks compare in terms of pricing structures? How should pricing even be determined?"

Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHTS

Visa has opted out of its $5.3 billion planned acquisition of Plaid after objections stemming from a Department of Justice (DOJ) antitrust lawsuit, The Wall Street Journal (WSJ) reported.

The antitrust suit challenged the acquisition, saying it would put Visa in a position to maintain a monopoly in the online debit card market. Plaid had been a “nascent but important competitive threat,” WSJ reported, and if Visa had been able to buy Plaid, it could have resulted in higher prices, less innovation, and more of an entry barrier for online debit services. Link here.

INDUSTRY HIGHLIGHTS

Budgeting apps have been shown to have the opposite result, and in reality, drive overspending. Link here.

Check out Everly.EU 2020 Challenger Banking Overview! Link here.

Four of the five main Irish retail banks have notified the competitor regulator of plans for an app-based payment system that would enable consumers to move money between each other with ease. Link here.

It’s been difficult not to obsessively watch bitcoin’s price since mid-December. It topped $40,000 last week after a remarkable bull run. Link here.

UNITED KINGDOM

Nala is launching a new money transfer app, Starling is on the hunt for acquisition targets, and Asto UK is set to shut down.

Tanzanian startup NALA is launching a new money transfer app in the UK in early 2021 to help the East African diaspora in the UK send money to Kenya, Uganda and Tanzania. The YC backed company recently gained approval from UK financial regulator the FCA. It already has 250,000 customers across East Africa. Nala is backed by well-known venture capital firms Accel and Y Combinator. Link here.

Starling Bank is hunting for acquisition targets in the lending market in a deal that could trigger a neobank-led wave of consolidation in the FinTech sector. Speaking exclusively to Sifted, Boden said the company is now actively searching “for lending businesses to buy”, with Europe’s non-bank lenders (including P2P firms) squarely in its sights. Link here.

Revolut has announced the launch of Confirmation of Payee for its more than three million UK retail customers. This latest feature forms part of Pay.UK’s anti-fraud initiative and further bolsters Revolut’salready award-winning anti-fraud features. Confirmation of Payee will give Revolut’s customers greater confidence that their payments are going to the right recipient whenever they pay a business or personal account. Link here.

Also, Revolut announced that it has submitted its application for a bank licence in the United Kingdom to the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), the next important step in its plans to create a financial super app. A UK banking licence will allow Revolut to further progress its development of highly personalised products to meet customers’ financial needs. Link here.

Asto UK Digital, a UK startup offering small businesses app-based invoice and expense management services, as well as short-term financing, is set to shut down after parent Santander UK pulled the funding plug. The company's 65 employees were told on an all-firm video call with CEO Nicolette Maury on Thursday that Asto will wind down by the end of the year, according to a source with first-hand knowledge. Link here.

EUROPE

Moss raised 21 million euros, Tink signs a new deal, and sync. expands its European operation.

Moss raised 21 million euros ($25.5 million) to accelerate the development of its payment and credit-card platform. The Series A funding round was led by Valar Ventures LLC, which is backed by early Facebook investor Peter Thiel, with participation from existing investors Cherry Ventures and Global Founders Capital. Link here.

Italian bank BANCA NAZIONALE DEL LAVORO (BNL) has signed a deal with Tink to launch a new multi-banking service. The deal is a result of BNP Paribas, parent group of BNL, signing an open banking extension with Tink this time last year. BNL has implemented Tink’s solutions for account aggregation and payment initiation, with personal finance management to follow. Link here.

Open-banking powered fintech sync. has touched down in two more European countries with the help of financial API provider TrueLayer. Through TrueLayer, sync. has already launched in several European countries, including France, Ireland and Spain, with the fintech also laying the groundwork in the Middle East after joining the first-ever Qatar Fintech Accelerator programme in October. Link here.

Czech Republic-based octobank is launching what it claims is Europe's first neobank dedicated to SMB e-shops and merchants. The startup has introduced a freemium plan for small merchants registered in the Czech Republic that includes a business Iban account and debit card, expenses and transaction management tools, and recurring payments, invoicing and payroll services. Link here.

UNITED STATES

Gemini acquires Blockrize, Marqeta has been chosen by Goldman Sachs, and Upgrade unveils new mobile checking account.

Cryptocurrency exchange Gemini has acquired FinTech Blockrize ahead of the launch of a credit card that lets users earn crypto rewards. Blockrize has been developing a credit card with cryptocurrency rewards and has already built up a 10,000-strong waitlist. Link here.

Marqeta, Inc, the global modern card issuing platform, announced that it has been chosen by Goldman Sachs to partner on its Marcus by Goldman Sachs checking accounts, which will launch in 2021. Marcus’ upcoming digital checking product will be another cornerstone of the company’s growing consumer portfolio of digital-first banking initiatives. Link here.

Upgrade, Inc., a neobank that offers affordable and responsible credit to mainstream consumers, unveiled today a new mobile checking account designed to deliver exceptional value to mainstream consumers. Upgrade charges no fees and lets customers earn 2% cashback on common everyday expenses and recurring payments, and 1% cashback on all other debit charges. Link here.

Greenlight Financial Technology, the fintech company on a mission to help parents raise financially smart kids, announced Greenlight Max, the first educational investing platform designed for kids. In 2017, the company launched a parent-managed debit card and app for kids to teach money management skills. Link here.

Rho Technologies, the NYC-based FinTech behind Rho Business Banking, has raised a $15 million Series A round led by M13 Ventures with participation from Torch Capital and Inspired Capital. Rho’s platform approach consists of a single solution that encompasses both collaborative finance software and commercial-grade banking. Link here.

Moven is to add a suite of bitcoin-related products to its 'bank in a box' platform, allowing financial institutions to tap the surging cryptocurrency markets. Moven is teaming up with digital asset firm NYDIG to provide turn-key bitcoin products and services, such as the ability to buy, sell, and hold bitcoin, savings accounts that pay interest in bitcoin, and a bitcoin credit card rewards program. Link here.

Fiserv, a leading global provider of payments and financial services technology solutions, announced a new agreement with Capital One that will offer customers secure, convenient, surcharge-free access to their funds at thousands of ATMs across the nation. The agreement will add more than 1,500 Capital One ATMs at Capital One branches, Cafés and select off-site locations to the MoneyPass ATM Network from Fiserv, one of the largest surcharge-free networks in the country. Link here.

SoFi to go public via SPAC backed by billionaire investor Chamath Palihapitiya. Learn more from their investor deck, provided by Jason Mikula. - "On track to exceed 3M members in 2021, up 71% after 6 consecutive quarters of accelerating YoY growth." Link here.

AFRICA

Glass House PR Ltd will host the first Africa Digital Finance Summit- ADFS. The summit will bring together Governments in Africa, stakeholders across the globe in the financial, economic, technology and blockchain industry with the aim to chart a pathway towards the future of finance in Africa. The inaugural event is themed “Decentralized Finance; our pathway to Financial Freedom”. This event will be held in Nairobi, Kenya on February 18th and 19th 2021, attracting different heads of African states and global delegates. Link here.

MOVERS AND SHAKERS

KOHO has found its new chief technology officer (CTO) after Kris Hansen stepped back from the role in August 2020. Jonathan Klein joins the challenger after four years as director of engineering at US e-commerce firm Wayfair. He has also held roles at event management company, Attend, and digital marketplace firms G2G and Etsy. Link here.

Global Processing Services (GPS) announced the appointment of Damien Gough as Head of Asia Pacific. With more than 14 years’ experience working with FinTechs across the region, Gough was previously Head of Issuer Processing and Enablement Partnerships, Asia Pacific, at Visa, where he was responsible for forging regional and global partnerships with third-party processors and BIN sponsors. Whilst there, he also spearheaded sales activities and solutions with leading regional fintech issuers. Link here.

This ends my weekly digest. Let me know if there are any questions or news/insights worth mentioning in next week's digest. Until the next!

Regards,

Marcel van Oost

marcelvanoost.com